At your request, ANZ will use best endeavours to obtain, within ten working days, details of the fees you were charged by the correspondent and/or intermediary bank that was used to send your payment.

The Chase international wire transfer fee is: Chase banks incoming.

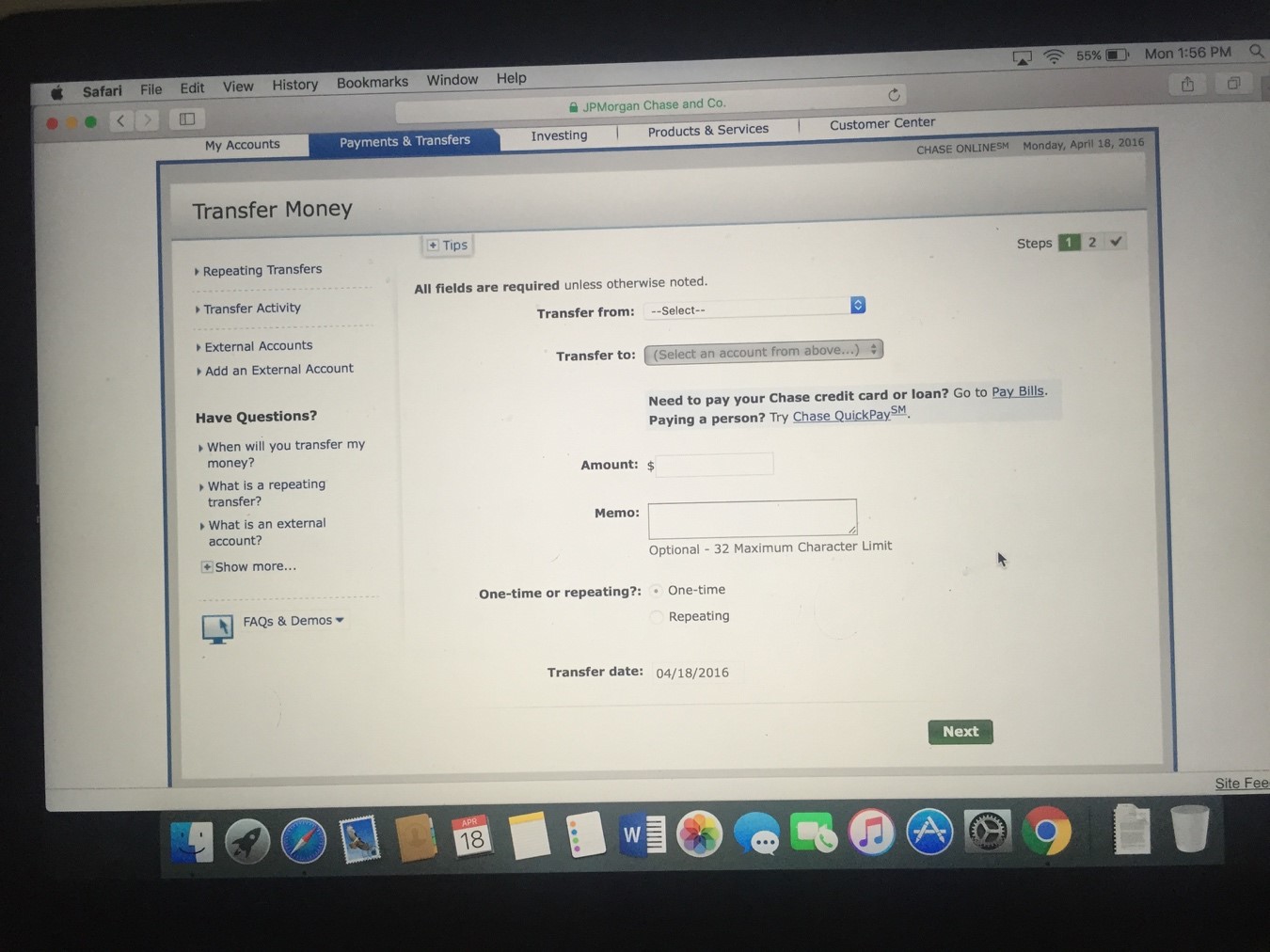

#Chase incoming wire transfer fee international how to

You'll learn how to save money and how to make smarter decisions about currency exchange. International and Domestic Wire Transfer Fees for Chase Bank are as follows. These fees may change at any time without notice and are subject to a number of factors including the value of the international payment made and whether the payment is sent in the local currency of the destination country. To Compare Travelling or sending money abroad Discover Chase's fees for international wire transfers and for using your credit or debit card abroad (incl. No reliance should be placed on these fees in determining the total cost for sending an international payment. The correspondent bank fees set out above are indicative only. You also need to take the exchange rate into account. (1) As you can see, it’s not only the upfront transfer fee you need to think about. Estimated correspondent bank fee when sending an International Money Transfer from ANZ Internet Banking or ANZ Phone Banking from AustraliaĪNZ will cover the correspondent bank fee Updated: Apr 22, 2022, 7:00am Editorial Note: We earn a commission from partner links on Forbes Advisor. 30 + possible intermediary bank fees + a likely marked-up exchange rate.

0 kommentar(er)

0 kommentar(er)